Here at COBE Real Estate, we watch Arizona’s commercial real estate landscape very closely—and from our seat, there are several cities and suburban markets that are showing up-and-coming promise. We believe now is a great time to take stock of where the momentum is building. Below are some of the cities and sub-markets we think are worth watching, plus what makes them attractive and how COBE is uniquely positioned to help clients capitalize.

Cities & Submarkets to Watch

From our research and observations, here are several cities and submarkets in Arizona that are up and coming in commercial real estate.

1. Buckeye

A standout for us is Buckeye. Traditionally rural, Buckeye is rapidly transforming. It has a lot of space to grow, excellent access via the Sun Valley Parkway, and increasing interest in industrial / distribution and manufacturing facilities. Big-box and warehouse uses are already moving in.

The city is still with relatively lower land costs compared to more central areas, but infrastructure is catching up. As COBE, our knowledge of Phoenix-metro trends and industrial users means we can help clients secure industrial sites here before land gets too expensive or scarce.

2. Goodyear & Avondale

The western side of Phoenix, including Goodyear and Avondale, is another area we’re excited about. Goodyear’s Estrella Falls development, for one, shows how mixed-use/retail/office/residential are being combined in newer suburban nodes.

Avondale has very strong population growth, and commercial activity is following close behind. For industrial & flex space especially, these areas are seeing increasing lease‐up rates and investor interest. Because of COBE’s brokerage and investment experience, we are well positioned to help clients evaluate users, returns, and risk in these emerging western valley markets.

3. Queen Creek

If you look at Arizona’s fastest-growing housing markets, Queen Creek comes up again and again. Steady housing stock growth, rising incomes, families moving in—this creates demand for retail, service-oriented commercial (e.g. medical, dining, local amenities), and land opportunities.

Queen Creek offers a sweet spot: still not fully “built out,” more affordable land, but close enough to the growth engines of Phoenix to benefit from spillover. COBE’s strength in land and investment property sales gives us a strong ability to help clients identify the best parcels here, negotiate well, and foresee the infrastructure & entitlement challenges.

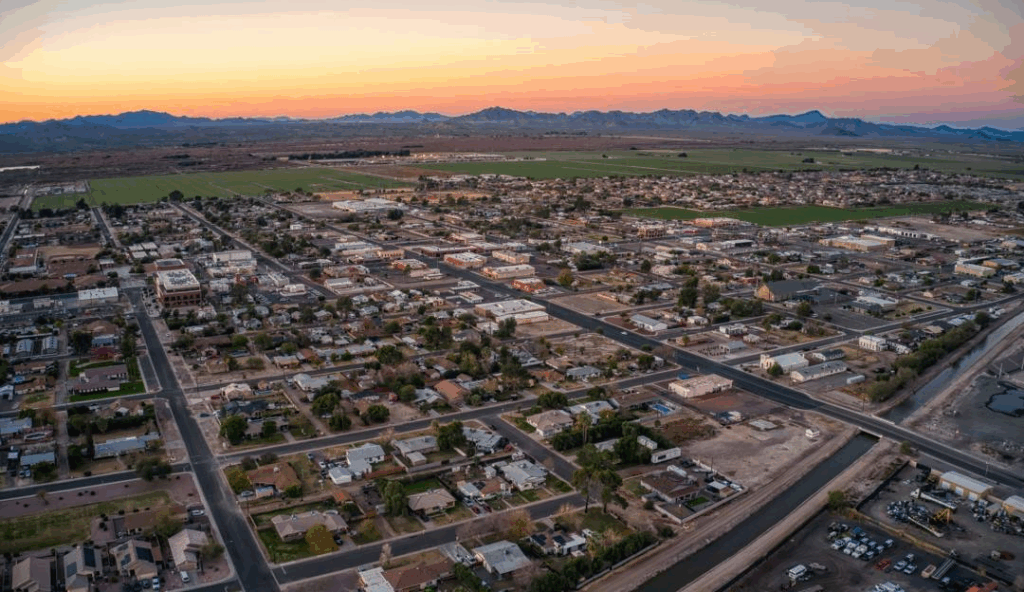

4. Tucson

Outside the greater Phoenix-Mesa area, Tucson is showing solid, stable growth. The industrial sector has good volumes, small-bay demand is strong, essential retail is doing well, and medical/healthcare submarkets are leasing.

For investors who want exposure to growth without as much of the overheated pricing that Phoenix faces in certain submarkets, Tucson is a compelling option. COBE’s team, while Phoenix-based, tracks Tucson closely—especially for clients looking for diversification or longer-term investment horizons.

Why COBE is Your Edge in These Emerging Markets

We believe that to turn promise into profit, you need more than just identifying where growth is happening—you need deep market understanding, local connections, and the ability to execute. Here’s how COBE Real Estate brings that to the table:

- Our full-service brokerage model means we don’t just help you buy or lease; we help you with site selection, market research, entitlements, tenant fit, and long-range planning.

- Over 50 years of combined experience, and more than $500 million in real estate volume, give us the insights and negotiation leverage to see around corners—what upcoming infrastructure may affect value, what land supply looks like, what zoning or traffic issues might emerge.

- Focused service: we combine research, marketing, follow-up, communication, and loyalty. We pride ourselves on being more than just transactional—we aim to build long-term client relationships so that when markets shift, we’re already in tune.

- Domain breadth: we cover all property types (industrial/flex, office, retail, medical/dental, land, investment), so we can help you adjust your strategy depending on which asset class is strongest in the city you’re evaluating.

What to Look Out For & Risks to Monitor

Even in up-and-coming cities there are risks. Here are things we always advise clients to watch:

- Infrastructure bottlenecks: water, roads, utilities. Some fast-growing places (e.g. Buckeye, Queen Creek) are pushing against limits.

- Zoning, permitting, land entitlement delays.

- Overbuilding risks—especially in industrial or multifamily sectors—as speculative development catches up. Even if demand is strong, excess supply can hurt returns.

- Market cycles: interest rates, inflation, financing costs can shift rapidly.

To sum up: Arizona remains one of the most exciting states for commercial real estate growth in the U.S. Right now, Buckeye, Goodyear/Avondale, Queen Creek, and Tucson are among the cities where we see the best confluence of demand, supply of land, affordability, and upward momentum. At COBE Real Estate, our deep experience, full-service brokerage model, and local market knowledge put us in the best position to guide clients to make smart investments in these markets, help them avoid common pitfalls, and secure long-term value.

If you’re thinking about investing, leasing, buying, or developing in any of these up-and-coming Arizona cities—or in other submarkets you’re curious about—we’d love to talk through what the best path forward looks like. After all, Quality Has a Name™